About The Firm

|

Sutton Hill provides specialized, comprehensive fundraising support for middle market private equity firms across all strategies and sectors. Our clients include firms that are newly founded, spin-outs of larger platforms, as well as longstanding private equity managers with decades of history.

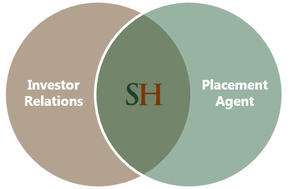

Sutton Hill works on a month-to-month retainer basis alongside private equity GPs to add depth, breadth and responsiveness to their fundraising and investor relations efforts. We provide dedicated bandwidth to ensure that marketing coverage is broad and investor matters are handled in a timely and thorough fashion. What We’re Not:

|

Long-Term Approach

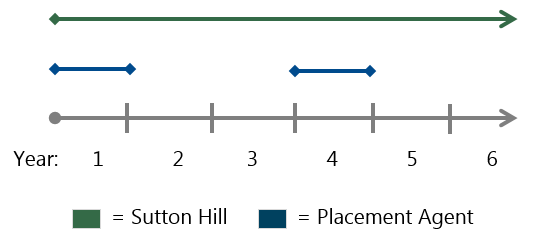

Sutton Hill is designed to be a long-term partner that helps maintain strong LP relations before, during and after the fundraise:

|

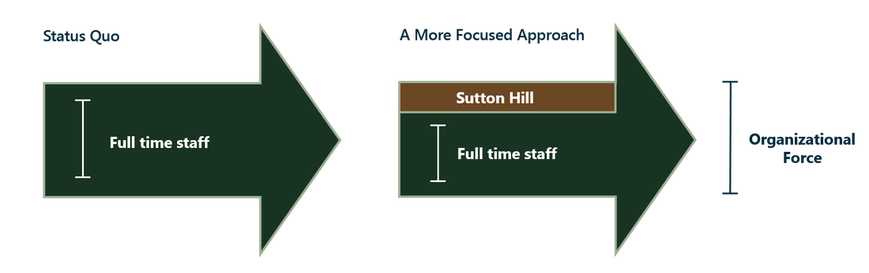

Preference Toward a Lean Organization

Sutton Hill helps clients keep costs under control, minimize organizational creep, and enables our clients to focus on sourcing and executing transactions.

Sutton Hill helps clients keep costs under control, minimize organizational creep, and enables our clients to focus on sourcing and executing transactions.